Personal Finance

Value Delivery Wise – A Manual for Opening the Value of Your Home

Could it be said that you are a mortgage holder searching for a method for exploiting the immobilized resources in your home? An offer delivery can assist you with opening the value in your home and using it for retirement and other monetary necessities. It tends to be a helpful and practical outcome. This arrangement investigates the idea of stock delivery, its advantages, and contemplations, and gives important data to settle on informed choices.

About stock delivery:

Value Delivery Wise is a monetary understanding that permits mortgage holders aged 55 and more established to deliver the value joined to their property while holding the option to live there. This can give you tax-exempt money or customary pay, contingent upon your own inclinations and monetary circumstance.

Stock Delivery Type:

Lifetime Home loan:

A proceeding with the contract is the most well-known type of offer delivery. This incorporates getting a credit equivalent with the home’s estimation while keeping up with power. The credit is reimbursed with revenue procured on the returns from the offer of the property when it is moved to legacy or long-haul care. A home relapse plan includes exchanging your land and open door to a value discharge supplier in return for a singular amount or repeating installment. You hold the option to camp out in the property until you clear or acquire when the property will be sold and the returns dispersed by the settled upon open doors.

Benefits of stock delivery:

Value Delivery permits you to extend the worth of your home without prompt expense misconduct. The assets delivered can be utilized to pack pay through withdrawals, finance a home improvement, pay down obligations, or cover a long period of costs. One of the extraordinary advantages of clearing up stock is that you can let loose your cash without scaling back or selling your adored home. It offers a method for keeping up with your life and partake in the solace of your home climate. Capital delivery plans are adaptable and can give funding in singular amounts or portions, contingent upon the terms. You are in charge of your future funds since you are allowed to choose how to utilize your extra offers. Many stock vesting plans offer inheritance insurance choices, permitting you to cover a piece of the home’s estimation for your beneficiaries. This permits you to leave a heritage while proceeding to serve as per your stock delivery arrangements.

Contemplations and understood risks:

Before deciding the speed of stock deliveries, it is basic to consider the inferred benefit effect of means tests, as well as annuity credits and legislative term decreases. Posting an enormous number of offers might influence your qualification for these advantages. Repeating contracts gather interest over the long run and are added to the credit balance. This intensifying impact can essentially expand the sum you owe over the long haul. Understanding longstanding counterclaims and getting a word of wisdom on managing them is basic. Most trustworthy offer delivery suppliers offer negative offers ensuring a guarantee that you or your beneficiaries won’t be under water for more than the property’s estimation. This assurance gives you true serenity if the worth of your property decreases from now on. It is critical to look for the counsel of autonomous monetary consultants who have practical experience in this space before starting any stock deal. They will evaluate what is going on, make sense of the choices accessible to you, and assist you with pursuing an educated choice.

Lawful appraisal and controls:

Whenever you have settled on a stock delivery plan, your provider will coordinate an evaluation of your property and do the essential legitimate checks. This will guarantee that the property meets the states of the arrangement you have picked, making the cycle go without a hitch. Toward the finish of the legitimate cycle, you will be tolerating the concurred reserves. You can decide to contract the Plutocracy as a single amount, with normal introduction functions, or a mix of both. Credit interest can be paid occasionally or added to the general equilibrium ahead of time. Activity discharges aren’t a great fit for everybody, so considering Druser is fundamental. Choices remember effective money management for lower-evaluated land, exploiting different reserve funds and ventures, and considering government advantages and help programs intended for retired folks.

An offer delivery can be a significant monetary device for mortgage holders hoping to open worth in their property. Gives admittance to tax-exempt money, adaptability, command over funds, and the capacity to remain at home. In any case, it is fundamentally vital to precisely consider the possible risks and look for a master exhortation to go with an educated choice. Step back and investigate the educator to comprehend the drawn-out answers before changing the speed. Discharge unanticipated occasions in your home with Stock Delivery and partake in your retirement time with true serenity.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

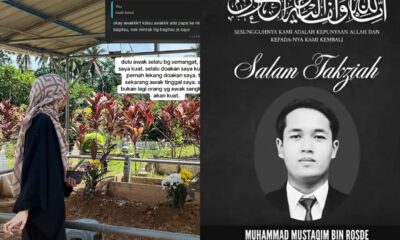

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen