Personal Finance

A Definitive Stock Exchange Organization Has Shown Up

Many brokers, even reliably productive dealers, have forever been obliged by their accessible assets, as the course of accurately and mindfully expanding your record size is tedious. Thus, many organizations are presently shifting focus over to their own exchanging firm as a way to speed up their exchanging professions without taking a chance with the enormous amounts of cash expected to accomplish similar objectives freely through conventional dealers.

What is Prop Exchanging and who is A definitive Dealer?

For those new to how to prop exchanging functions, prop exchanging is essentially ordinary web-based stock and forex exchanging, yet merchants don’t take a chance with their cash. All things considered, you will be given a generally subsidized exchange account, the graciousness of our exchanging firm (prop firm). A definitive objective is for the two players to be gainful together. The dealers consent to execute exchanges while the organization bears the monetary gamble and divides the potential benefits made by the vendors. The organization initially lays out the abilities of the dealers before giving capital.

Extreme Brokers is one of the recently framed free exchanging firms offering account funding for gifted dealers. The determination cycle used to distinguish commendable vendors depends on a capability cycle in which forthcoming dealers should enlist. Show of capacity through exchanging is expected to accomplish the benefit target set by the organization. This valuation account doesn’t gamble genuine cash (for clear reasons). However, runs on the MT4 server of an outsider specialist. This server is additionally utilized for retail exchange by genuine clients of the merchant. So this is a precise impression of what occurs in the live market.

How can it function?

The biggest record size presented by Extreme Merchants is worth more than multiple times the enrollment charge expected to pursue an assessment. To place this in numbers, the most extreme record size is $400,000 with an enrollment expense of $1,799. The enrollment expense for the record more modest than $10,000 is $99. A benefit focus of 10% (or higher) is expected at the hour of assessment. When the broker returns to finance the record, the equilibrium is reset and they are then permitted to keep 80-90% of the benefit they make (the excess 10-20% goes to the organization). If this sounds excessively liberal or even crazy for Extreme Brokers, if it’s not too much trouble, recollect that the assessment cycle is intended to eliminate however much karma as could be expected from the situation.

In the first place, there are limits on the most extreme misfortunes permitted consistently and consistently, so a merchant who is essentially entering an enormous position expecting to hit a grand slam can’t do as such without results. Second, merchants should partake for at least 3 exchanging days, so having an incredible day doesn’t mean you will get 400,000 records. Third, when the 10% benefit target is reached, the broker should rehash the interaction, presently going for the gold benefit, under similar limitations. Hence, toward the finish of the interaction, just focused merchants with the right gamble on the board and exchanging techniques ought to pass.

However, for the previously mentioned 2-step capability (marked as Exemplary Test), there is likewise the choice of a 1-step capability (marked as Fast Test) where merchants need to stir things up around town benefit target just a single time. To make up for the simple errand, the everyday and most extreme misfortune limits, and the permitted influence are decreased, and the enlistment cost is expanded somewhat. No matter what sort of valuation a dealer picks, they share one thing practically speaking. It implies that you must be great at exchanging to find lasting success.

Extreme Brokers permits merchants to open situations on all major, minor, and colorful cash matches, records, wares, and normal digital currencies. It depends on the broker to pick the best-performing market and execute the technique as indicated by the test rules. All procedures are gladly received, including scalping, supporting, swing exchanging, and news exchanging, and EAs are additionally accessible (don’t mishandle them). Dealers can decide on end-of-the-week exchanging (generally not permitted) and no-quit exchanging (typically required) assuming it suits their procedure. There is likewise the choice to pay a premium at the information exchange, which ensures a 90% benefit share during the funding stage.

It is worth focusing on that dealer who has arrived at the financing stage, they are not expected to meet some other benefit targets or meet the base month-to-month exchanging necessities. The objective of the raising support stage isn’t for the merchants to live under long-lasting pressure, but for the two players to bring in cash. For risk the executive’s purposes, the last condition is that day-to-day and stop misfortune limits keep on being regarded.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

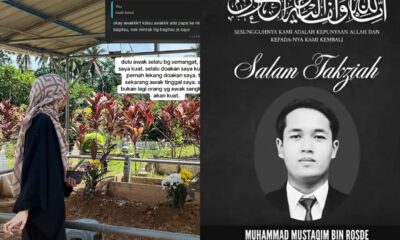

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen