Personal Finance

Charge Treatment for Ostracizes – Guide for European Organizations

In the present globalized world, it is normal for experts to cross lines. However, this liquidity makes an intricate labyrinth of expense liabilities, particularly for exiles, generally known as ostracizes. For European organizations utilizing ostracizes, it isn’t simply significant, understanding these assessment obligations is fundamental. This article furnishes an exhaustive manual for managing unfamiliar charges, focusing on the moves organizations face and the techniques to successfully address them.

Grasping the unfamiliar assessment circumstance:

The assessment circumstance of exiles is intricate and still up in the air by their expense home status. This status is by and large characterized by how much time an individual spent in a specific country during the fiscal year. Contrasts in charge status among occupants and non-inhabitants can altogether affect an exile’s expense risk. For instance, an inhabitant might pay the charge on pay procured around the world, while a non-occupant might pay a charge just on pay acquired inside the country. Understanding these subtleties is the initial step to a successful unfamiliar assessment of the executives.

Challenges that organizations face:

European organizations employing ex-pats frequently face difficulties, for example,

- The intricacy of global duty regulations: Every nation has its assessment regulations, which can shift enormously. Understanding and following these regulations can be an overwhelming undertaking, particularly for organizations with exiles in numerous nations.

- Twofold Tax collection: This happens when exiles should pay charges both in their nation of beginning and in the nation where they at present dwell. Twofold tax collection can essentially build the taxation rate on ostracizes and obstruct global development.

- Managerial Weight: Organizations need to monitor their ex-pat charge responsibility, guarantee charges are determined and paid accurately, and manage any expense debates that might emerge. This requires a critical venture of time and assets.

Procedures for viable financial administration:

Given these difficulties, organizations genuinely must have a compelling methodology for dealing with their unfamiliar inhabitant charges. One of the main things is to figure out charge arrangements and assessment deals. They are arrangements between nations expected to keep away from or lessen the impacts of twofold tax collection. These give huge expense reserve funds to ex-pats and are fundamental devices for viable duty organizations.

Another procedure is to carry out a duty evening strategy. These strategies are pointed at guaranteeing what is going on for exiles doesn’t improve or deteriorate because of their expense commitments. They take care of their business by having the organization settle the ex-pat assessments and afterward deduct the very measure of expense that the ex-pat would have paid assuming they had remained in their nation of origin.

At last, looking for the guidance of an expense proficient is priceless. Our expat charge administrations give guidance custom-made to your organization’s particular conditions, guarantee consistence with all applicable expense regulations, and help you plan and execute a compelling duty procedure.

Contextual analysis: US Expat Duty in Europe:

To show these focuses, think about the instance of an American ostracized in Europe. US charge regulation depends on citizenship, not residency. This implies that US residents, paying little mind to where they live or their pay, should record expense forms and conceivably pay charges to the US government. This can make various duty issues for US residents dwelling in Europe.

In any case, there are procedures you can use to deal with these issues successfully. For instance, the US has charge arrangements with numerous European nations that can lessen or kill twofold tax assessment. Furthermore, US charge regulation accommodates numerous rejections, and endless remittances that can be utilized to diminish your US charge obligation. Understanding and exploiting these arrangements can essentially diminish the taxation rate on Americans positioned in Europe.

Contextual analysis: European nations with zero unfamiliar annual assessment.

At the opposite finish of the range, a few European nations force zero unfamiliar personal duty on their residents and inhabitants. These incorporate nations like Malta, Andorra, and Monaco. Living and working in these nations can give huge tax breaks. Nonetheless, it is essential to in like manner figure out the particular expense laws of these nations and plan. For instance, these nations may not burden unfamiliar pay but rather may force different charges, (for example, Tank or government-backed retirement burdens) that you ought to consider.

To keep away from the unfamiliar assessment trap:

One of the greatest difficulties for ex-pats is staying away from the purported “ex-pat charge trap”. Here the ostracize will pay charges in both the nation of origin and the host country. There are a few methodologies you can use to stay away from or limit the unfamiliar expense trap. This incorporates comprehension and utilizing charge arrangements, guaranteeing unfamiliar tax reductions, and utilizing exceptions and derivations accessible under the assessment laws of your home and host nations.

Conclusion:

Overseeing ex-pat charges can be a complicated errand. However, with the right information and methodologies, it very well may be overseen really. By understanding the expense commitments of ex-pats, the difficulties they can posture, and procedures to address these difficulties, European organizations can guarantee they meet their assessment commitments while supporting their ex-pats.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

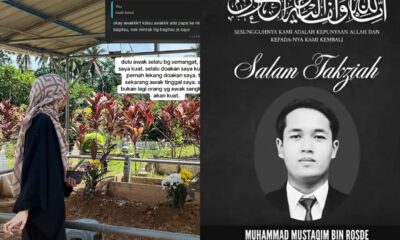

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen