Personal Finance

How Can You Dissect the Capability of Your Rental Investment Property?

Putting resources into investment properties with a solid kind of revenue and potential for long-haul monetary development can be a productive business. Not all investment properties are made equivalent, so taking into account the capability of every investment property is crucial for going with a brilliant investment choice.

A significant expertise that enormously affects your presentation as a land financial backer is knowing how to assess the capability of a rental investment property. Knowing how to appropriately examine the capability of a rental venture property can assist financial backers with settling on informed choices, diminish hazards, and increment the profit from their land investments.

Financial backers can become familiar with an incredible arrangement about investment suitability and productivity via cautiously assessing key measures, for example, area, economic situations, rental interest, property quality, and monetary contemplations. This article is expected to aid financial backers in investigating the capability of rental investment properties, so kindly read underneath.

1. Location:

Investigating the reasonability of a rental investment property requires cautious thought of its area. The area of land influences long-haul achievement and benefit. However, your local Baltimore property supervisor can assist you with leading a property investigation.

Financial backers ought to break down if the offices, for example, parks, business regions, clinics, and schools are close by. An advanced framework works on the personal satisfaction of planned inhabitants and builds the engaging quality of the property.

The area of a rental investment property is critical to consider as it straightforwardly affects rental pay, property estimation, and in general return potential as a venture. The most elevated leases, the briefest opportunities, and the most significant yields on venture can be joined with great areas.

2. Expected Rental Pay:

Rental pay potential is a significant component to consider while assessing the capability of a rental investment property. Knowing the rental pay potential permits financial backers to survey the income and productivity of their venture.

Track down comparative properties and explore average rental costs in your area. Search for homes that are comparative in size, elements, and area. This correlation gives a beginning stage to deciding the normal rental pay for the subject property.

3. Market circumstance:

Financial backers ought to stay up to date with market conjectures and patterns. Check land reports, and local news and counsel land specialists to decide the heading of the market. Likely future rental interest and property estimation increments can be anticipated by knowing creating areas, advancement plans, and forthcoming framework projects.

Via cautiously looking at economic situations, financial backers can find areas with solid rental business sectors and wise venture possibilities. Market factors impact rental pay, inhabitance rates, and the general return capability of investment properties. Financial backers with a firm comprehension of market patterns can pursue better investment property choices that supplement their venture targets and empower them to settle on information-driven choices.

Parts of an Investment Property Investigation:

1. Introductory expense:

While assessing the capability of an investment property, surveying the underlying expense of the investment is significant. These underlying expenses can essentially affect the general benefit and suitability of your venture. The price tag of land addresses a critical beginning investment. Arranging a sensible cost relies upon the property’s condition, area, and market esteem. Financial backers ought to do a similar market examination to guarantee that they are following through on a satisfactory cost for their property.

Forthright expenses are significant in precisely computing the likely return on initial capital investment and deciding the reasonability of an investment property. To find out what you want to spend, making a thorough financial plan that covers your underlying expenses is all the best.

By assessing startup costs, financial backers can guarantee they have an adequate number of assets to take care of their startup costs and keep away from unexpected monetary charges. Considering these expenses can assist financial backers with pursuing informed choices and foster a reasonable monetary technique for their investment property venture.

2. Expenses:

Costs are a significant component while assessing the capability of an investment property. Understanding the expenses related to purchasing and keeping an investment property is basic to making exact monetary figures and laying out the benefit of the property. Recognizing and assessing different working expenses, for example, local charges, insurance payments, utility charges, support and fixes, property the executive’s charges, finishing, and general upkeep, is vital to financial backers. To make an exact gauge, cautiously concentrate on verifiable information and counsel a specialist.

3. Income:

Pay is a significant element while assessing the capability of an investment property. Financial backers can all the more likely comprehend a property’s benefit and income by assessing its procuring potential.

Financial backers can pick the right rental cost in light of the property’s area, size, condition, and conveniences. To decide market rental costs and guarantee that the property can draw in occupants at cutthroat rates, research equivalent properties close by.

Gauge the normal inhabitance pace of a property, or at least, the level of time that it will be leased. Consider factors, for example, the property’s appeal, economic situations, and rental interest. High inhabitance rates lessen opening periods and guarantee stable rental pay for proprietors.

Conclusion:

Deciding on the feasibility of a rental investment property requires an intensive examination of a few elements. Financial backers can amplify their odds of coming out on top by considering the area, economic situations, rental pay potential, property conditions, monetary worries, and hazard appraisals.

Continuously get your work done, look for proficient assistance if vital, and coordinate your investment objectives with land potential. Doing so expands your possibilities of buying a productive investment property and making long-haul monetary progress in the housing market.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

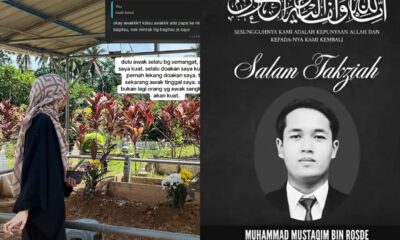

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen