Personal Finance

Investigate Land Supporting Choices – From Conventional Home Loans to SBA Credits

The land is a worthwhile speculation choice with long-haul abundance creation potential. In any case, one of the greatest difficulties for financial backers is tracking down appropriate supporting choices to fund their land business. Luckily, there is an assortment of funding choices accessible, going from customary home loans to Private company Organization (SBA) credits. Visit this site to study the different choices accessible more deeply in land funding. This incorporates now, exorbitant loans presented by confidential banks, for example, hard cash moneylenders, who have fundamentally quicker endorsement times than laid-out banks. Another choice is value funding. This remembers taking advances from consenting financial backers for trade for shares in land.

Customary Home loan:

Conventional home loans are the most widely recognized and most involved supporting choice for the acquisition of properties. These are presented by banks and other monetary foundations and require the borrower to make an upfront installment and reimburse the credit throughout some undefined time frame (generally 15 to 30 years). Financing costs on customary home loans can fluctuate given a borrower’s FICO rating and different elements.

Customary home loans are a well-known choice for individuals hoping to purchase land. These home loans are presented by banks and other monetary foundations, and the borrower makes an initial investment and reimburses the credit throughout some period, regularly 15 to 30 years.

One of the vital elements in deciding the financing cost of a customary home loan is the borrower’s credit score. Organizations with high FICO assessments are for the most part offered lower loan costs since they are thought of as safer for banks. What’s more, different factors like the borrower’s pay, business history, and credit-to-esteem proportion can likewise influence loan costs.

Conventional home loans regularly have a decent financing cost for the whole term of the credit, providing the borrower with the upside of steady and unsurprising regularly scheduled installments. This permits property holders to spend plan and plan for their future costs successfully. Likewise, ordinary home loan installments by borrowers develop value in land, giving long-haul monetary security and adaptability.

Remember that conventional home loans frequently require an initial installment. This is the level of the price tag of the property that the borrower should settle front and center. How much the initial installment relies upon elements, for example, the financial soundness of the borrower and the credit program utilized. Generally, the higher the initial installment, the better the credit terms, for example, lower financing costs and more limited advance terms.

Confidential Funding:

Confidential support is one more choice for land financial backers who don’t meet all requirements for a customary home loan or don’t have any desire to go through the conventional loaning process. Confidential support comprises getting cash from people or privately owned businesses rather than banks or monetary foundations.

Confidential support offers a few benefits to land financial backers. In the first place, it permits financial backers who don’t meet the severe necessities of customary home loans to get assets for speculation properties. This is particularly helpful for those with not exactly wonderful FICO ratings or without consistent pay.

Hard cash advance:

A hard cash credit is a kind of confidential advance that is for the most part utilized for momentary land ventures. These advances are given by confidential financial backers or organizations and are ensured by the actual property. Hard cash credits are many times utilized by land financial backers who need quick funding or experience issues fitting the bill for a customary home loan.

Dissimilar to conventional home loans frequently presented by banks and other monetary organizations, hard cash credits have more adaptable necessities. This implies that even borrowers with not exactly amazing credit or modern kinds of revenue might be qualified for hard cash advances. The fundamental variable that banks consider while offering hard cash credits is the worth of the property utilized as a guarantee. This is because, in case of a default, the moneylender can recuperate its venture by selling the property.

Hard cash credits likewise have a quicker endorsement process than customary home loans. This is because private lenders are not exposed to the very severe standards and rules that conventional agents should comply with. Thus, borrowers can frequently accept their assets surprisingly fast, bringing in hard cash credits a well-known choice for time-touchy land exchanges.

In any case, it is essential to take note of that hard cash credits by and large have higher loan costs and charges contrasted with customary home loans. This is because it implies more gambling for the moneylender. Likewise, hard cash credits are by and large present moment, normally months to years. Borrowers should be ready to take care of their credits in a generally brief timeframe or investigate other supporting choices.

SBA advance:

SBA credits are a sort of funding choice presented by the Independent Company Organization, an administration organization that helps private ventures. Even though SBA credits are fundamentally for organizations, they are additionally accessible for land speculations.

SBA credits are a well-known choice for entrepreneurs hoping to get assets for different purposes. These credits are supported by the Private venture Organization, and the public authority ensures a piece of the credits in the event of default.

One benefit of SBA credits is the somewhat low financing costs contrasted with conventional bank advances. That makes them an appealing choice for organizations hoping to fund development, purchase new hardware, or meet their functioning capital requirements.

Utilizing SBA credits for venture property gives borrowers longer reimbursement terms and lower initial installment necessities contrasted with conventional advances. This makes it more straightforward for business people to gain the resources they need to develop their business or create extra pay.

Conclusion:

With regards to land support, there is nobody size-fits-all arrangement. Since various funding choices enjoy various benefits and detriments, financial backers must cautiously think about their singular necessities and monetary circumstance before settling on a choice.

-

Entertainment1 year ago

Entertainment1 year ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment1 year ago

Entertainment1 year ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment1 year ago

Entertainment1 year ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment1 year ago

Entertainment1 year ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment1 month ago

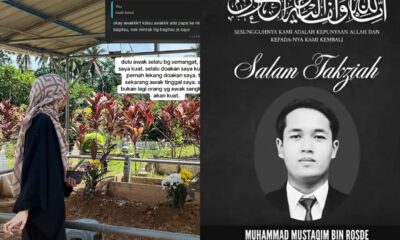

Entertainment1 month ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment1 year ago

Entertainment1 year ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment1 year ago

Entertainment1 year ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen