Business

Modern Threats to Businesses

Threats – Businesses must prepare for, defend against, and manage a variety of threats to continue succeeding. Understanding potential threats and having access to technologies and tools that assist in identifying, assessing, and mitigating them is essential for risk assessment.

Modern Threats to Businesses:

This article investigates the various dangers organizations face, the importance of observing and overseeing dangers, and how warning alarms can help.

How to incorporate robust risk assessment policies to mitigate the risks your company faces?

It is essential to identify the various risk categories that the business faces when devising risk management strategies.

Some of the most important considerations are listed below.

Credit and financial risk:

Businesses face important risks from financial issues like debt and insufficient cash flow.

Quite possibly the most well-known way clients face income issues is the point at which a borrower becomes bankrupt or assumes command. Your company may face cash flow issues because of this, which could set off a chain reaction.

In this instance, it is only dependent on the proportion of business sales generated by a single customer. No, but if a single company generates more than 30% of its revenue, you are in serious trouble. The problem should it fail. In a similar vein, the solvency of a business may be in jeopardy if several smaller customers default simultaneously.

Insufficient income is a tremendous danger to organizations. On the off chance that an organization doesn’t have the assets to pay its obligations when due, the organization might turn out to be bankrupt and in danger of liquidation.

Particularly, the current business climate is erratic, and doing business with businesses that operate on low margins is risky. They can quickly become bankrupt because they are susceptible to inflation, rising costs, or changes in the environment.

Instructions to distinguish monetary gamble:

Perceiving industry-explicit dangers and observing them intently is vital for your business. Perhaps the most effective way to do this is with business information instruments that demonstrate the degree of chance related to your business. You can safeguard your business from financial risks and respond quickly to emerging threats by verifying potential existing partners, customers, vendors, and vendors.

Examples of scenarios for which mitigation is suggested are:

Including new customers:

Accepting clients who are experiencing financial difficulties could be detrimental to your company.

Follow-up with current customers:

Early identification of the above advance notice signs and other monetary troubles implies you have a lot of opportunity to do whatever it takes to deal with your dangers or cut out your business completely if vital.

Locate new clients:

By avoiding the generation of leads that fail credit checks and identifying viable customers, you can save your sales team time and money.

Management of Supplies:

Your business can suffer greatly if a supplier fails. By keeping an eye on your suppliers’ financial health, you can spot problems early and respond accordingly.

How can better strategic choices be made?

One of the best ways to make better strategic decisions is to get an overview of how a certain industry is doing. For instance, assuming you notice that different organizations in your industry are battling, you can forestall or limit the harm by being more careful and focusing on likely issues.

One more important component to screen is to recognize new contenders or new contestants to the market that might be expected rivals from now on. By looking at your logs, you can see how far you’ve come. Start-ups that are expanding quickly can be a serious threat, and it is necessary to protect their market position.

Legal and compliance risks:

Building major areas of strength for a framework is an overwhelming errand as rules and guidelines keep on developing. The introduction of the GDPR has been one of the most important developments in recent years. Except for maximum fines for companies that do not comply, the GDPR imposed stringent requirements on businesses regarding how they handle customer data.

The requirements for anti-money laundering (AML) compliance are also changing. The implementation of the Bank Secrecy Law and its regulations are among the changes. The “AML rule” is another name for it. The capacity to detect and report suspicious activity is one of the reasons behind these modifications. This aids in the reduction of money laundering, particularly fundamental offenses like market manipulation and securities fraud.

How to remain consistent?

To avoid the dangers associated with businesses engaging in fraudulent activity, it is essential to develop procedures that are GDPR and anti-money laundering (AML) compliant.

Since London is frequently regarded as the world’s capital of money laundering, international policymakers are placing an important emphasis on AML. With £88 billion in money laundering annually in the UK, lawmakers are attempting to address the issue by enforcing even stricter regulations and penalties, which frequently include substantial fines and imprisonment.

Other important things to think about:

Monetary Factors All organizations are impacted by the more extensive financial climate. However, a few organizations are more vulnerable than others. Exchange rate fluctuations, for instance, can hurt international businesses. Take precautions to avoid risks and remain aware of the various economic factors that could affect your company or industry. Purchaser spending, government methodologies, financing costs, and more can influence business achievement.

Operational and process risk:

There are many ways to deal with this risk, which are easier to manage for a well-organized company. A broken machine that needs expensive repairs or a failed hard drive that stores data that is essential to your company’s survival Regular cloud data backups and machine health checks demonstrate the importance of staying organized and importantly lessen the impact of these issues. Because you run the risk of causing the process to fail, you should delegate this responsibility to multiple individuals. For instance, when individuals fail to back up their data, the company is at risk.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

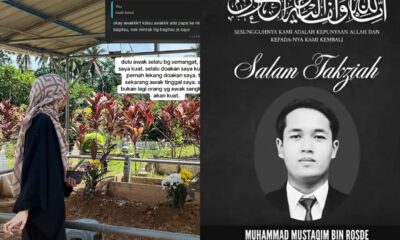

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen