Personal Finance

Risk Management Methodologies Utilizing Metatrader 4 Tools and Elements

Financial exchanges, including cash, item, and financial exchanges, are intrinsically unsafe. Yet, the way to support progress in this unpredictability is the compelling execution of sound gamble-the-board procedures. At the core of these techniques is MetaTrader 4 (MT4). It is a broadly perceived stage liked by dealers all over the planet for its finished arrangement of hazard-the-board devices and highlights.

Countless believed dealers support this stage and proposition various variants customized to various exchanging needs. For instance, the AvaTrade MT4 stage offers merchants a versatile arrangement with renditions accessible for portable, work area, tablet, and web. These choices guarantee a smooth exchange experience and permit clients to deal with their gamble productively, no matter what their favored gadget or stage.

Figure out the risk the executives:

In the first place, we should grasp the risk of the board. Risk the board in exchanging alludes to a methodical way to deal with measuring and moderating the potential misfortunes that a broker might confront. It contains pre-characterized rules for variables, for example, position size, stop misfortune level, take benefit level, and most extreme drawdown. The objective isn’t to dispose of hazards completely, yet to oversee them at a level that dealers can easily deal with and keep on exchanging the essence of inescapable misfortunes.

Influence the executives:

MT4 permits merchants to set the influence of their records. Utilizing influence can increment both your misfortunes and your benefits. Understanding and overseeing influence is in this manner a significant piece of chance administration. Merchants have some control over likely misfortunes via cautiously picking influence in light of their gamble hunger. A basic guideline of thumb isn’t to utilize an excess of influence. A moderate methodology could incorporate proportions like 1:10 or 1:20.

Choice of parcel size:

MT4 permits dealers to pick the exchanging volume or the parcel size. This element is a fundamental piece of chance administration, as both expected benefits and potential misfortunes increment with expanding part size. We suggest that you base your part size choices on your balance, risk resilience and the subtleties of the item exchanged.

Stop Misfortune and Take Benefit Requests:

Stop Misfortune (SL) and Take Benefit (TP) orders are one of the most essential gamble-the-board tools in MT4. These orders consequently close the position when they arrive at a foreordained degree of benefit or misfortune, individually. Setting SL and TP levels permits dealers to oversee chance and prize without constantly observing their exchanges.

End stop:

A following stop is a high-level sort of stop misfortune request that moves with the market. Assuming that the market moves in support of yourself, your stop levels will naturally change, possibly getting more benefits. Assuming the market moves against your situation, your stop level won’t change and your misfortunes will be restricted. Following Stop on MT4 takes into account adaptable gamble the board that can adjust to changing economic situations.

Cautions and notices:

MT4 permits brokers to set up alarms and notices on unambiguous market occasions or cost levels. This element permits brokers to respond rapidly to advertise changes and immediately oversee exchanges and likely dangers.

Market examination instruments:

A fruitful gamble on the board likewise requires a decent comprehension of the market. MT4 offers an assortment of diagramming devices, specialized pointers, and principal examination highlights to assist merchants with settling on informed choices. These devices assist with recognizing potential market inversions, times of high unpredictability, and key help and obstruction levels that are significant for risk to the executives.

Computerized exchanging and MQL4:

MT4 upholds computerized exchanging through Master Guides (EAs), scripts written in MetaQuotes Language 4 (MQL4). Dealers can foster EAs to execute risk in the executive’s systems naturally. This component removes the feeling from exchanging and guarantees the predictable use of chance administration rules.

Modules and Additional Items:

There are numerous modules and modules accessible to broaden the usefulness of MT4. For instance, devices like the Gamble Mini-computer assist traders with rapidly evaluating the dangers related to a possible exchange.

Risk the board is a fundamental discipline in exchanging. A very much arranged risk the executive’s system can assist merchants with enduring times of misfortune and guarantee long-haul endurance. MT4 offers an assortment of hazard-the-board devices. However, it is critical to recall that their powerful use relies upon the’s comprehension broker might interpret the market and individual gamble resistance. Whether it’s setting the right stop levels, picking the right parcel size, or carrying out the robotized risk on the board with an EA, each broker ought to fit their gamble the executive’s way to deal with their exchanging style, technique, and monetary objectives.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment6 months ago

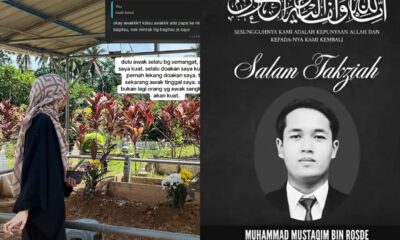

Entertainment6 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen