Business

The Essential Guide to Commercial Business Insurance

Do you own a business and aren’t sure what kind of insurance to get? Is your company covered by insurance? You, the manager, have the final say. You can shield your company from a variety of unexpected risks by signing up for business insurance. Most business owners prefer to start with business owners insurance, which offers three coverages for new businesses: insurance for business property, general liability, and income. However, it is strongly suggested that you purchase employee-only business insurance if you own a large business with many employees. Prepare yourself for an explanation of the various kinds of business insurance and the advantages they offer business owners.

When starting a business, insurance policies to think about are:

There are various kinds of protection relying upon the business wherein you work. This is due to the distinct risks that each business faces. There are numerous insurance policies available, but the following are some common ones, particularly for novices.

Coverage for general liability:

Your company can be shielded from claims for damage caused by GLI insurance. Personal injury on the job, property damage, and bodily injury are all examples of claims.

Insurance for Commercial Property:

Your rented or owned buildings and some of the equipment you use to run your business are protected by the insurance mentioned above. However, it is essential to be aware that insurance does not cover damage caused by earthquakes or floods. It is suggested that you purchase insurance, such as commercial flood insurance if you require protection against these kinds of disasters.

Insurance for Business Income:

Business pay protection will supplant lost pay assuming you can’t proceed with your business because of property harm. You can continue your business and use the compensation money to cover some of your expenses.

What do insurance policies do for businesses?

Insurance is the process of minimizing the risk of property loss and safeguarding individual interests. The industry makes a significant contribution to the country’s economic expansion. It is simple to comprehend the significance of insurance. The advantages and functions of insurance contracts in businesses are listed below.

- Protection and safety

- Make financial resources available.

- Fostering economic expansion.

- Go about as a raising support source.

- Provide medical assistance to you and your employees.

Business insurance is important for all businesses and industries. Insurance is a good idea not just for new businesses but also for established ones. Additionally, most business owners must purchase CT business insurance. You may initially ignore it, but when risks arise when you do not have cash on hand, you realize how important business insurance is to your company.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

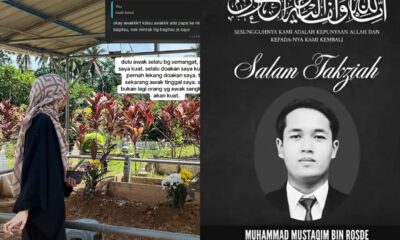

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen