Business

Top 9 Best Banking Mistakes Small Business Owners Make

Managing a successful small business necessitates a lot of trial and error. Most owners of small businesses have a lot to say about their biggest mistake. We assist new businesses in avoiding the most common banking blunders they make.

1. Spend money you don’t need:

Bank loans can be beneficial to small business owners, but taking out a loan before you need it can cause financial issues. The money you borrow may run out quickly if you do not intend to use it for anything specific. Before you get a business credit, choose precisely where the assets will be spent and the way that it will assist with expanding your pay.

2. If it is impossible to confirm the price:

When you need money, you might be willing to lend money to anyone. There are no two bank loans the same and paying off a loan can be difficult due to high fees. Before agreeing to take out a loan, always check the fees and interest rates. Typically, these costs are expressed at an annual rate (APR).

3. Neglect the payment plan:

When applying for a bank loan, it’s also important to know what the payment requirements are. You might not have enough time to get your money back if you take out a loan with a short repayment term. Consider where the money to repay the loan will come from and how likely it is that you will receive it daily before agreeing to take out a loan. If you have extra time, it can help you prepare for unexpected results and changes.

A company’s financial reputation can be damaged if loans are not paid back on time or if payments are late. It can also influence your company’s reputation, making it nearly impossible to obtain future credit or loans.

4. If you don’t consider bank prepayment:

In a similar vein, cash advances can be a lifesaver if you are on the verge of falling behind on loan payments or losing your earnings because of missing orders. Small businesses can quickly get out of trouble thanks to bank cash advances. Additionally, bank prepayment typically outperforms credit card prepayment in both quality and cost.

5. Negate the impact on credit:

When applying for a cash advance or opening a new account, some banks may inquire about your hard credit. A high number of credit inquiries can lower your overall score and make it harder to get a business loan in the future. Most credit card prepayments increase credit utilization. However, you might be able to get cash advances from online banks without hurting your credit score.

6. If you do not have access to online banking:

Online banking provides a level of practicality and convenience that traditional banks do not. You still need an online bank account for other procedures, even if you already have your preferred in-person bank. It is simple to track funds, transfer money between accounts, and request cash advances with online banking. Being a successful owner of a small business necessitates having a thorough understanding of all your financing options.

7. Money from both personal and business sources:

It may appear simpler at first to use your personal checking and savings accounts for business expenses. However, it is simpler to organize everything if these income and expenses are kept separate from the beginning. Today, it’s helpful and simple to start an independent company checking or bank account on the web.

If owners of small businesses separate their expenses from the start, they will also find it easier to pay their taxes. Furthermore, opening a Visa or business credit extension card turns out to be considerably more helpful when you can undoubtedly see the monetary status of your business.

8. Look for interest rates to rise:

Moving money around between bank accounts to find the best interest rates can be tempting. However, this might be a bothersome job that takes up a lot of time that could be used on more pressing business matters. Instead, deposit your funds at an online bank with consistent and competitive interest rates.

9. Your business is not being built correctly:

Your banking options and obligations can be affected by how your business is structured. The most common kinds are limited liability companies (LLCs) and sole proprietorships. If you only use your registered business name, it might be hard for other employees to put money in the bank. Alternatively, you can set up your business as an LLC or DBA and keep your name on your bank account. If you own multiple businesses, an LLC is also a great option.

You can learn a lot as the owner of a small business. In the end, your errors become useful learning opportunities. However, by implementing a few key strategies, such as separating your personal and business accounts from the beginning, you can improve your business’s financial management.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

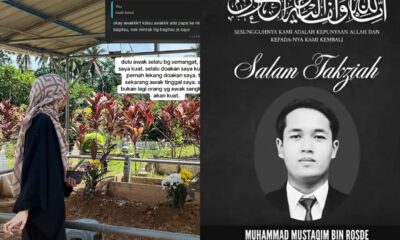

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen