Personal Finance

What Is a Brilliant IRA Rollover?

In the present questionable financial environment, it is basic to safeguard and broaden your retirement portfolio. One investment choice that has acquired ubiquity as of late is the Gold IRA rollover. In any case, what precisely is a Brilliant IRA rollover and how can it function? This article digs into the subject and reveals insight into the vital parts of this venture methodology.

What are IRA accounts?

Before we plunge into the subtleties of Gold IRA rollover, we should initially comprehend what a conventional IRA implies. A Customary IRA is an expense-advantaged account intended to assist peopling put something aside for retirement. Commitments to conventional IRAs are for the most part charge deductible. This implies that you can decrease your available pay for the year.

Assets inside a conventional IRA are regularly put resources into stocks, securities, shared reserves, or other monetary instruments. Over the long run, these investments can develop and furnish individuals with a type of revenue for retirement.

Gold IRA Rollover Definition:

A gold IRA rollover is a methodology that permits financial backers to change over their current retirement account resources into actual gold or one more valuable metal while keeping up with the tax cuts related to an IRA.

Rather than putting your resources solely in stocks and bonds, moving some or all of your Conventional IRA to actual gold offers an elective method for safeguarding your resources and support against expansion.

Why think about a Gold IRA rollover?

Diversification:

Putting resources into actual gold through an IRA rollover permits you to differentiate your portfolio past customary paper resources like stocks and bonds. Valuable metals go about as a fence against market unpredictability and financial flimsiness.

Abundance Support:

Dissimilar to government-issued money, whose worth deteriorates because of monetary factors, for example, expansion, actual gold will, in general, hold its worth after some time. For a long time, it has been viewed as a dependable store of riches.

Safe Resources:

All things considered, gold has been seen as a place of refuge resource in monetary vulnerability and international shakiness. Gold costs will generally ascend in unrest, providing financial backers with a feeling that everything is good.

Gold IRA Cons:

decreased liquidity:

Dissimilar to stocks and bonds, which can be effortlessly traded on trades, actual gold should be put away and overseen by a supported overseer. This absence of liquidity might restrict our capacity to get to assets in a crisis rapidly.

Capacity and protection costs:

The actual capacity of valuable metals includes some major disadvantages, which incorporate secure storage spaces and protection inclusion. These expos can take away from the general profit of your venture.

Likely instability:

While gold is much of the time considered a place of refuge resource, costs can in any case be unstable in the present moment because of variables like market feeling and macroeconomic circumstances. It is vital to recollect that putting resources into any resource conveys some level of chance.

Restricted development potential:

While actual gold can safeguard against expansion and protect abundance, it may not give critical development contrasted with other investment choices like stocks and land.

Expansion in charges and authoritative weight:

Laying out and keeping a Gold IRA commonly has higher charges than a Conventional IRA because of the extraordinary idea of the investment. Also, this interaction might require more regulatory work to consent to the guidelines and guidelines connected with valuable metals inside the IRA.

How is the Silver IRA rollover not the same as the Gold IRA rollover?

Indeed, the Silveto process is marginally unique to the Gold IRA as far as the valuable metals included. The two choices include changing over customary IRA assets into actual valuable metals held in willful IRAs, with the principal contrast being the kind of metals bought.

In a silver IRA rollover, a financial backer decides to purchase and hold actual silver rather than gold. The cycles and methods are for the most part equivalent to Gold IRA rollovers, including choosing a worker caretaker, financing another record using wire move or rollover, choosing endorsed silver items, and actual silver. Incorporates buy and capacity at supported capacity areas. under parental assurance.

A few financial backers decide to join both gold and silver inside their intentional IRAs as a component of their expansion methodology. This approach permits us to exclusively support the potential dangers related to every metal while exploiting the exceptional characteristics every metal offers.

For items to be covered, it’s critical to take note of that specific standards set by the Inward Income Administration (IRS) apply to Gold and Silver IRAs. Whichever choice you consider, it means a lot to check with your picked caretaker to guarantee consistency with IRS guidelines.

Eventually, picking a Gold IRA rollover or a Silver IRA rollover relies upon your venture objectives, risk resistance, market viewpoint, and individual inclinations. Consider working intimately with monetary specialists and consultants who can give direction custom fitted to your singular conditions.

Conclusion:

Gold IRA rollovers make the most of the strength and abundance of protection properties related to actual valuable metals to offer people the chance to enhance their retirement portfolios. However, before exchanging your IRA for gold, make sure to do a broad examination and look for proficient exhortation before pursuing any significant investment choices.

By doing whatever it takes and joining forces with a trusted, intentional IRA caretaker, you can exploit this elective investment methodology and secure your future monetary prosperity.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

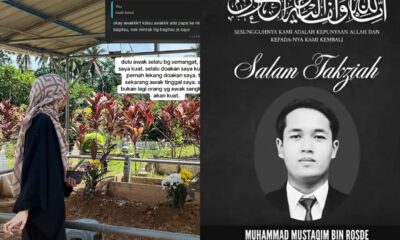

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen