Personal Finance

What Type of Credit Is Best for The Normal Salaryman?

He has typical pay and is attempting to earn enough to get by, yet needs somewhat more assistance. Approaching the right sort of advance can give him much-required alleviation and assist him with arriving at his monetary objectives quicker. Also, it tends to be achieved proficiently. However, it very well may be difficult to comprehend the reason why one credit is better compared to another.

To make things more straightforward for all typical pay workers, we’ve got some margin to explore and gather this significant data in this blog entry to feature the absolute most ideal credit choices that anyone could hope to find for average pay workers. If you’re searching for dependable guidance on which credit is appropriate for you to rapidly handle monetary troubles, read on.

Outline of credit choices for individuals with normal pay:

Is it safe to say that you are a normal salaryman searching for credit? There are a few credit choices accessible. Individual credits are a well-known choice and can be utilized for different purposes, including obligation combinations, home remodels, and startling costs. Notwithstanding, if your FICO assessment isn’t satisfactory, loan fees might be higher.

If you own a home, this kind of credit might be a choice. This kind of credit involves the value of your home as a guarantee and by and large has a lower financing cost than an individual credit. Another choice is a credit association advance.

Credit associations frequently offer lower loan fees than conventional banks and may have more adaptable loaning norms. Before applying for credit, make certain to survey what is happening and spending plan as needs be to stay away from late installments and expected monetary difficulties.

Individual credits – a decent choice if you want:

We as a whole need some additional cash occasionally. Maybe your vehicle stalled suddenly or you had a well-being crisis that expected a surprising cost. At the point when this present circumstance emerges, individual credit can be a superb choice.

An individual credit is a credit that isn’t gotten by security like a vehicle or a house. All things being equal, it depends on your financial soundness and capacity to reimburse the credit. It’s an incredible method for getting the cash you want quickly without setting up security.

Home Value Credits: Influence Your Home Value:

For some property holders, their house isn’t simply a spot to reside, but a significant venture. A home value credit permits you to take advantage of the value of your home and have cash accessible for different costs, from home redesigns to surprising doctor’s visit expenses.

Essentially, a home value credit permits you to get cash involving the resources in your home, which is the contrast between the equilibrium on your home loan and the ongoing worth of the home.

This kind of advance for the most part offers lower loan costs than different types of purchaser support, making it an alluring choice for individuals hoping to raise assets without bringing about exorbitant interest obligation. Whether you need to fund a huge buy or just solidify exorbitant interest obligation, a home value credit might be the ideal answer for your monetary requirements.

Payday Advances – Exorbitant Interest Transient Arrangements:

Payday credits have turned into a famous choice for individuals who need speedy cash, yet the exorbitant loan fees related to these transient credits can represent a serious monetary weight not too far off. It very well might be a brief arrangement, yet the drawn-out effect of expanding obligation at such exorbitant loan costs could demolish.

It’s critical to consider all choices cautiously before taking up a payday credit and to have a strong arrangement to take care of your obligation at the earliest opportunity. With appropriate preparation and planning, there are more feasible ways of addressing your monetary requirements without falling back on these exorbitant loans.

Mastercard Obligation Union – Join Many Obligations:

Overseeing funds can be troublesome, and piling up Visa unpaid liability is perhaps the most well-known monetary trouble. Every obligation has its own loan fee and installment plan, and it tends to be overpowering to monitor many obligations on various Mastercards. This is where Mastercard’s obligation union becomes possibly the most important factor.

Consolidating many obligations into one installment can work on the installment cycle and lower financing costs. By combining Mastercard obligations, individuals can recapture control of their funds and work toward an obligation-free future.

It’s critical to investigate as needs be and find a trustworthy joining program or monetary counsel to direct you through the cycle.

Shared loaning: get assets from others:

Shared loaning is a shrewd method for funding a venture without the inclusion of customary banks or foundations. This is profitable for the two borrowers and financial backers, as borrowers can get the assets they need at lower loan costs and financial backers can get a better yield on speculation contrasted with low-yield bank accounts.

With the developing fame of online stages like LendingClub, Succeed, and Upstart, the most common way of interfacing borrowers with individual funders has never been simpler. Shared loaning has changed the customary loaning framework, giving everybody admittance to the assets they need to make their fantasies work out. So if you’re searching for financially savvy support, consider distributed loaning as a suitable choice.

Conclusion:

In any event, while picking how to get a credit to expand your typical pay, it’s critical to settle on certain the choice fits both your present moment and long-haul objectives. Individual credits offer an incredible arrangement if you want them. However, you want to painstakingly consider the mix of loan fees and reimbursement periods to pursue a brilliant choice.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

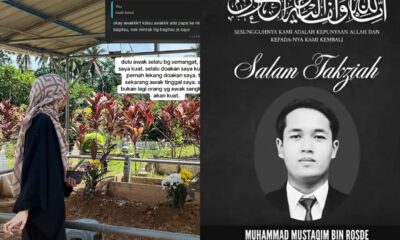

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen