Personal Finance

Keeping Away from The Traps of Altered Gift Agreements

Assuming you’re a policyholder, you might have known about a changed gift contract (MEC) and the limitations that accompany it. To try not to fall into the MEC trap, it is vital to comprehend what the changed Award Understanding is. This guide subtleties all that you want to be aware of the altered gift understanding and how to get around it.

What is a changed benefits understanding?

A changed blessing contract (MEC) is a disaster protection strategy that is grouped by the Inner Income Administration (IRS). This order demonstrates that the extra security strategy gets an abundance premium installment contrasted with the demise benefit installment. When the breaking point is surpassed, the arrangement status changes to MEC.

For what reason are there altered gift contracts?

The Changed Blessing Understanding was brought into the world with the presentation of the Specialized Incidental Income Demonstration of 1988 (TAMRA). The reason behind this regulation was to battle tax avoidance and extra security strategy misrepresentation, in addition to other things.

This regulation characterized a life coverage strategy as an agreement to give a demise benefit upon the passing of the protection. You should likewise breeze through the 7-portion premium assessment where the premium is paid for more than 7 years. Assuming the arrangement meets this test, credits, and withdrawals of the approach’s money esteem are tax-exempt, permitting policyholders to concede burdens and develop.

Some paid high charges to involve disaster protection as a speculation to stay away from charges. Thus, the money worth of the protection expanded more quickly than the demise benefit. To battle this, the law presented a changed enrichment contract order and forced extra charges on installments for a considerable length of time.

How to keep away from MEC traps?

A changed blessing contract assignment changes the situation with the strategy and has an unfavorable expense impact. As a policyholder, you want to keep away from the MEC trap to exploit the expense-excluded advantages of your strategy. Here are a few procedures to accomplish this.

Understanding the Seven Compensation Charge Test for Insurance Policies:

To stay away from the MEC trap, you should figure out the insurance payment structure and the 7-portion installment test. The expenses paid in the initial seven years of a strategy decide if the strategy breezes through the seven-section premium assessment. A top-notch structure that disregards the 7-portion premium cutoff will be dependent upon the MEC assignment.

Pick a low exceptional installment:

One method for keeping your insurance from becoming MEC is to pick a lower installment. This makes the strategy meet the exceptional furthest reaches of 7 portions. For instance, if you purchase a strategy with a demise advantage of $1 million, you can pick a low premium of $30,000 or less each year.

Consider charges paid rather than high insurance installments:

If you have any desire to exploit your collected money esteem, you can purchase paid augmentations (PUAs) rather than paying high charges. PUAs permit policyholders to make a singular amount installment for a strategy, which is then used to fabricate cash esteem. This decreases premium installments and keeps the approach consistent with the 7-portion premium cutoff.

Be careful with strategy supporting:

Non-MEC policyholders can acquire the money worth of their arrangements tax-exempt. Be that as it may, assuming the approach is assigned as MEC, the IRS will burden the credit as standard pay, which will have an unfavorable duty influence. Thus, we should be cautious with the approach credits.

Track strategy execution and charges:

It is essential to screen insurance execution and installment installments continually. If not, the approach could surpass the 7-installment limit and be assigned as MEC. By following your arrangement, you can make any vital acclimations to guarantee your approach doesn’t surpass the 7-portion premium cutoff.

Conclusion:

If the gift contract assignment is changed, your protection will have an unfavorable assessment influence. To keep away from the MEC trap, comprehend and follow the 7-portion charge test, pick low expenses, purchase expense additional items, be cautious with protection credits, and protection execution, and follow protection rates is fundamental. This permits you to exploit the expense-excluded advantages of your arrangement without being dependent upon the duty ramifications of the MEC assignment.

-

Entertainment2 years ago

Entertainment2 years ago“Haha aku terhibur la tengok Aqish tu, banyak makan gula ni” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Selamat pengantin baru Sherry, tak jemput pun” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Satu family kena gula2 ke camne ni hahaha” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Sherry memang yg kawan baik, kawan jtuh gelak dulu baru tolong hahaha” – Netizen

-

Entertainment7 months ago

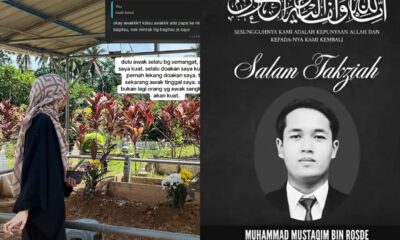

Entertainment7 months ago“Arwah adik saya memang tak pernah jumpa Wani, Kami kenal Wani pun masa dia dah takde” – Kakak Mustaqim

-

Entertainment2 years ago

Entertainment2 years ago“Anisha sangat elegan, dia selalu tersenyum” – Netizen

-

Entertainment2 years ago

Entertainment2 years ago“Kakak Ameerah Bolkiah, happy birthday, miss you” – Anak Azrinaz Mazhar Hakim

-

Entertainment2 years ago

Entertainment2 years ago“Dah berumur pun cantik, macam Amy Mastura” – Netizen